UK Accountant Shares Step-by-Step Guide On How To Manage Your Money On Payday

The '50-30-20' Rule Was Introduced in 2005

As UK citizens face high living costs and a wage slump, many are finally considering their budgets and finances. Burdened with bills, high-interest credit card debt, student loans, and mortgage payments, keeping up with monthly expenses has become challenging for the average UK household.

Financial expert Nischa Shah, in her YouTube podcast, unveiled an accessible and straightforward budget tracker that she designed after trying countless money management strategies over the years. It helps you see monthly income and expenses and stay on top of your present and future goals.

The qualified chartered accountant and a former investment banker believe that reviewing the tracker on payday can help avoid late fees or penalties, ensure you save enough for the future, and set the right tone for the month ahead. Shah thinks that understanding how to handle money and being in control is one of the most vital life skills to learn today.

It doesn't matter how much you make annually. What matters is how you manage and make the most out of your money to find a balance between "living in the moment and planning for the future," Shah added. "If you find something to do that is easy to do and maintain, then managing your money stops feeling like a chore."

The '50-30-20' Rule

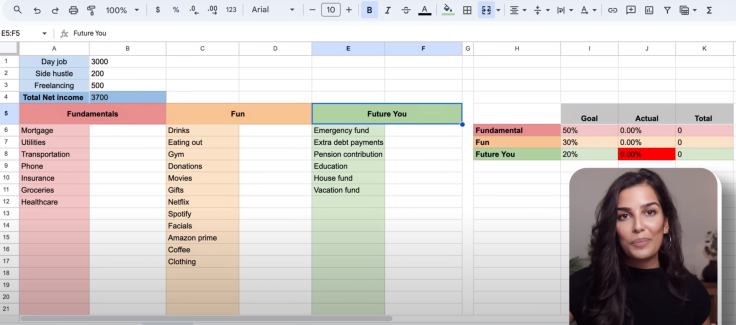

Shah's tracker on a spreadsheet follows the "50-30-20" rule, introduced in 2005 in the book "All Your Worth: The Ultimate Lifetime Money Plan."

She categorized monthly spending into three buckets: "fundamentals," "fun," and "future you." Shah says 50% of your net income should go towards the fundamental bucket, which includes needs like utilities, insurance premiums, healthcare, mortgage payments, and transportation costs.

Around 30% should be for fun activities like dining out, movies, clothing, gifts, vacations, and other recreational engagements. The "Fun" bucket includes the costs that enrich our lives with joy and unique experiences.

The "future you" column will receive 20% of your post-tax paycheck towards retirement investment vehicles, pension contributions, emergency funds, house or education funds. This bucket is an investment toward a life you envision years later.

How To Use The Spreadsheet?

The budget tracker is easy to use, making it perfect for beginners and potentially useful for professionals.

Step 1: Calculate Your Net Income

Figure out how much post-tax money you bring home from your 9-5 job, side hustles, and even dividend payouts. This amount should also include contributions to pensions or any retirement investment vehicles because pension contributions go toward the "future you" column. Move to Step 2 after entering the total net income on the sheet you get from adding inflows from individual gigs.

Step 2: Input Costs and Overhead Details

Start filling the buckets with the non-negotiable fundamental monthly costs. You can customize the attributes and make them more detailed. Include gas and internet bills, house maintenance overheads, etc., as required.

Shah urges you to be clear about the fun stuff. "You want to clarify these categories from the outset. You don't want your fun stuff creeping into your needs," she said. The fun bucket includes non-essential, optional spending and lifestyle upgrades.

The last bucket ensures you pay yourself first. Shah says maintaining the "future you" is much easier when you set up automatic bank transfers so that a portion is immediately transferred to a separate savings account when your salary hits the bank.

Step 3: Check If You Are Meeting Your Goals

Have a look at the rightmost table on the spreadsheet. When all the details are in place, some cells in this table will automatically change colour to tell if you are meeting your goals.

The "Actual" column displays a percentage based on your costs. You can compare it with the "Goal" column to check where to cut costs and bump contributions. Remember, the allocation for each bucket is just a reference point, and you can tweak these percentages based on your financial situation.

The Month At A Glance

According to Shah, checking this tracker on your payday can help simplify bills and stay current on payments. A 360-degree view of all your costs and simple goal-tracking features give you a clear idea of the portion of the income you spend in terms of percentages towards these categories. You also can see the exact amount as well.

She believes that when you create a system that works for you, you remove friction and the need for willpower. There's no excuse not to save money anymore.

The tracker also helps correct course if you have spent more than you should or didn't contribute enough to your future funds. Depending on the status report, the cell colours will change to red or green.

Most seldom stick to their monthly budgets. If you need to spend less on the fun bucket, explore ways to have the same experiences at a lower cost.

© Copyright IBTimes 2024. All rights reserved.