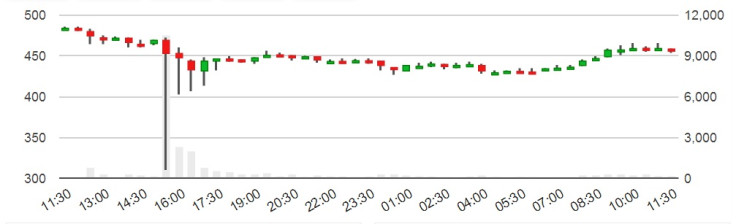

Bitcoin Flash Crash Sees Price Fall as Low as $309

The price of bitcoin fell to as low as $309 (£185) on one exchange yesterday, as cryptocurrency markets continue to suffer from ongoing downward trends.

In what is being referred to as a "flash crash", the price of one bitcoin fell by around $150 on the Bulgaria-based exchange BTC-e.

The price plunge can most likely be attributed to a cascading effect brought about by margin trading, the practice of trading on credit.

In a blogpost following the crash, margin trading critic Raffael Danielli blamed BTC-e traders for liquidating their positions.

"The shape and especially timing of the crash points towards margin traders being liquidated (or stop orders being executed)," Danielli said.

"The fall below 400 was mainly due to a lack of bids in the order book, and not because the market believed that the true value was below $400."

The price on BTC-e swiftly recovered to above $400 and bitcoin is currently trading at around $455, reinforcing Danielli's analysis.

According to Danielli, this flash crash could have been avoided by temporarily suspending trading.

"Halting trading during extreme downwards volatility could have easily averted the bloodshed among margin traders, by giving other market participants more time to thicken the order book," Danielli said.

Although prices on other exchanges were affected by the drop, only BTC-e saw bitcoin's value fall below $400. CoinDesk's index fell to $435, while the price of bitcoin on Bitstamp did not fall below $445.

Prices of most major cryptocurrencies have seen a general decline over the last few days, as a number of factors contribute to market-wide turmoil.

Analysts have blamed various events for this trend, including a major sell-off at Hong Kong exchange BitFinex, a recent US government report that highlights the risks associated with virtual currency, New York's BitLicense proposals, and the introduction of new sophisticated trading techniques.

© Copyright IBTimes 2024. All rights reserved.